As medical professionals, navigating career transitions is an inevitable part of your professional journey. Whether you’re considering changing specialties, pursuing further education, or transitioning to a new role within or outside of medicine, careful financial planning is essential to ensure a smooth transition and maintain financial stability. In this guide, we’ll explore the importance of planning for career transitions with the help of experts like John Moakler and provide practical strategies for managing your finances during periods of change.

Assessing Your Financial Situation

Before embarking on a career transition, take the time to assess your current financial situation to understand where you stand and identify areas for improvement. Evaluate your income, expenses, assets, liabilities, and savings to gain a clear picture of your financial health. Determine your financial goals and priorities for the transition period, such as maintaining a certain standard of living, covering educational expenses, or building a financial cushion to support you during the transition.

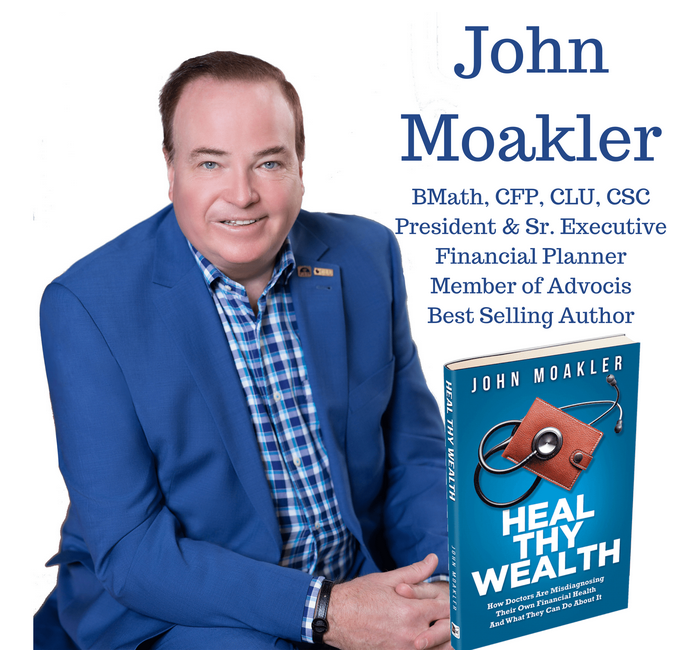

Consider factors such as your anticipated future income, potential changes in expenses, and any financial obligations or commitments that may affect your transition plan. By understanding your financial situation and setting realistic goals with the help of experts like John Moakler, you can develop a comprehensive financial plan to support you through the transition and achieve your long-term objectives.

Creating a Transition Budget

Once you’ve assessed your financial situation, create a transition budget to outline your income, expenses, and financial goals during the transition period. Identify any anticipated changes in income or expenses associated with the career transition, such as changes in salary, relocation costs, educational expenses, or job search-related expenses. Allocate resources accordingly to cover essential expenses, such as housing, utilities, groceries, transportation, and healthcare, while also setting aside funds for savings and discretionary spending.

Developing a transition budget allows you to proactively manage your finances and prioritize spending based on your needs and objectives. Consider using budgeting tools and resources to track your expenses, monitor your progress, and adjust your budget as needed throughout the transition process. By creating a realistic and flexible budget with the help of experts like John Moakler, you can maintain financial stability and avoid unnecessary financial stress during periods of change.

Maximizing Savings and Investments

During a career transition, maximizing your savings and investments can provide a valuable financial cushion and support your long-term financial goals. Review your current savings and investment accounts to identify opportunities for growth and optimization. Consider contributing to tax-advantaged retirement accounts, such as 401(k) plans or individual retirement accounts (IRAs), to take advantage of potential tax benefits and build wealth over time.

Explore investment strategies that align with your risk tolerance, investment goals, and time horizon. Diversify your investment portfolio across asset classes, such as stocks, bonds, mutual funds, and real estate, to reduce risk and maximize potential returns. Additionally, consider automating contributions to your savings and investment accounts to ensure consistent progress towards your financial goals, even during periods of transition.

Managing Debt Wisely

Managing debt wisely is essential during a career transition to avoid unnecessary financial strain and maintain financial flexibility. Review your current debt obligations, including student loans, credit card debt, mortgage or rent payments, and other loans. Develop a plan to prioritize debt repayment based on factors such as interest rates, loan terms, and financial goals.

Consider strategies such as refinancing or consolidating debt to lower interest rates and streamline payments. Explore options for income-driven repayment plans or loan deferment programs to temporarily reduce or suspend loan payments during periods of financial hardship. By managing debt wisely and making strategic decisions about debt repayment with the help of experts like John Moakler, you can minimize financial stress and maintain control over your finances during a career transition.

Exploring Insurance Options

Insurance is a crucial component of financial planning, providing protection against unexpected events such as illness, injury, disability, or death. Review your current insurance coverage, including health insurance, life insurance, disability insurance, and liability insurance, to ensure that you have adequate protection for your needs and circumstances.

Evaluate your insurance needs based on factors such as changes in income, family size, health status, and career path. Consider options for supplemental insurance coverage, such as long-term care insurance, critical illness insurance, or umbrella insurance, to enhance your overall protection and address specific risks. By exploring insurance options and optimizing your coverage, you can mitigate potential financial risks and protect your financial well-being during periods of transition.

Seeking Professional Guidance

Navigating career transitions and managing your finances during periods of change can be complex and challenging. Consider seeking professional guidance from a financial advisor or planner who specializes in working with medical professionals. A knowledgeable advisor can provide personalized advice, tailored solutions, and expert insights to help you navigate career transitions and achieve your financial goals.

Work with a trusted advisor to develop a comprehensive financial plan that addresses your unique needs, objectives, and concerns. Collaborate with your advisor to review your financial situation, develop a transition strategy, and implement practical solutions to support your career goals. By partnering with a professional advisor, you can gain confidence and peace of mind knowing that your financial future is in capable hands.

Planning for career transitions and managing your finances during periods of change are essential components of financial preparedness for medical professionals. By assessing your financial situation, creating a transition budget, maximizing savings and investments, managing debt wisely, exploring insurance options, and seeking professional guidance from experts like John Moakler, you can navigate career transitions with confidence and achieve your long-term financial goals.

Embrace financial preparedness as a proactive approach to managing your finances and achieving success in your career transitions. By taking control of your financial future and making informed decisions, you can position yourself for financial stability, resilience, and prosperity throughout your professional journey. Prioritize financial planning and preparedness today to ensure a brighter and more secure tomorrow, no matter where your career path may lead.